LTL freight bill audits and disputes are one of the biggest headaches for LTL brokerages. LTL brokers already know they need automation. What they haven’t had is a tool that truly handles the complexity of LTL invoices. Until now.

Traditional accounts payable systems claim to automate AP. But when LTL invoices come in, full of unexpected accessorials, re‑rates, re-classes, and fuel adjustments, those tools fall short. LTL brokers aren’t asking for education anymore. They’re asking for a freight bill audit tool that actually works for LTL.

This article explains why the existing solutions fail and how Lighthouz AI delivers the first real solution tailored for LTL invoice audit and dispute automation.

Why LTL Bill Audit Automation Claims Always Fall Short

Most AP automation platforms were not built for LTL freight billing. They focus on matching totals, but LTL bills are not simple totals. They contain dozens of variable elements that matter:

- Line‑item accessorials (e.g., detention, liftgate, residential delivery)

- Class, weight, and route‑based pricing

- Fuel surcharge nuances

- Carrier‑specific rules and tariff applications

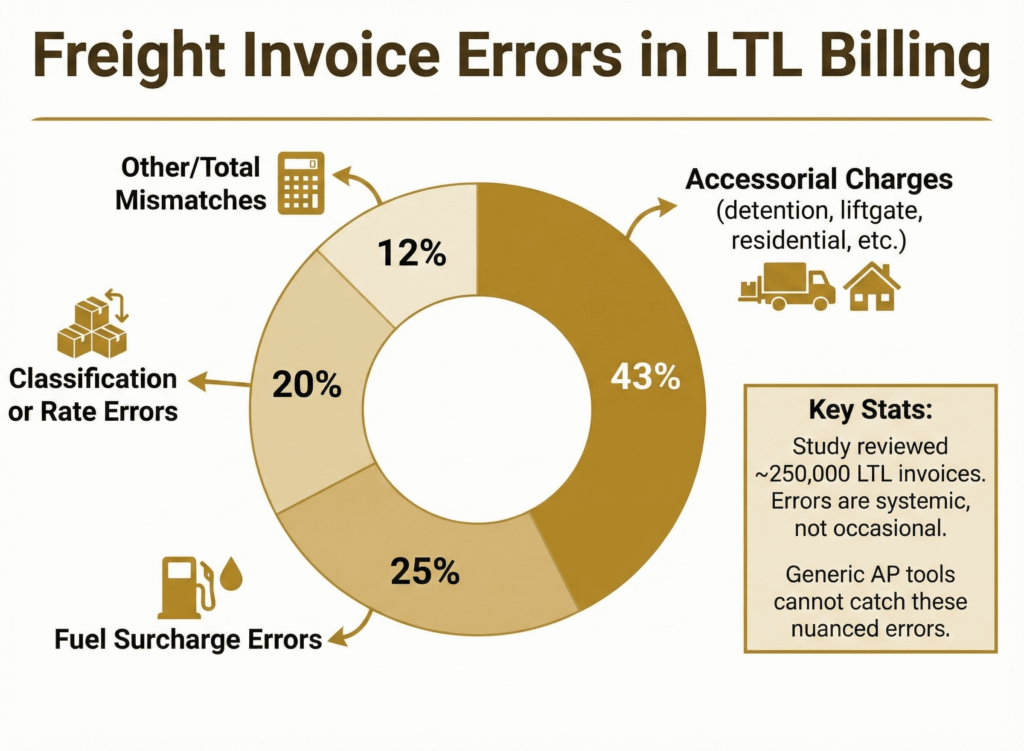

These factors demand logic, not just workflow. Industry research shows that a substantial share of freight invoices contain errors that require audit attention.

According to a freight invoice audit study that reviewed nearly 250,000 LTL bills, 42.8% of detected exceptions were due to inaccurate accessorial charges (such as liftgate, residential, limited access, etc), and many others stemmed from differences in linehaul, re-classification due to reweights or redimensions- making it critical to look beyond simple total mismatches.

In other words, LTL invoicing mistakes are systemic, not occasional, and traditional AP tools don’t have the intelligence to interpret them.

The Real Sources of LTL Invoice Errors

1. What Causes Billing Variance?

Let’s look closer at why LTL invoices are so prone to mismatches:

A. Accessorial Charge Mistakes

Extra services such as liftgate, limited access, or residential delivery often get billed incorrectly when shippers rely on memory and don’t have their systems set up correctly, and brokers don’t have an easy way to validate the charges.

Fact: In a large LTL invoice dataset, accessorial charges accounted for the largest category of errors.

B. Misclassifications Errors

Incorrect NMFC code, freight class, and rates can inflate costs significantly because of reclassification charges by the carrier and higher rates in the reclassed tarriff.

C. Reweighs and Reclasses due to changes in weight or dimensions

Shippers often ship products with different weights and dimensions compared to their initial request. This leads to reweighs and reclasses, changing the linehaul and fuel charges, and applying an inspection charge penalty.

A broader freight audit survey shows that 15–25% of freight invoices contain some form of error, illustrating how common billing discrepancies are across transportation operations.

2. Why These Errors Matter for LTL Brokers

Unlike standard bills, discrepancies in LTL billing:

- Increase operational overhead

- Require escalation with carriers and shippers

- Delay cash flow

- Erode margins

No wonder brokers want automation that does more than route tasks — they want real validation and resolution.

3. Simply Automating Workflows Isn’t Enough

Some automation vendors tout features like OCR, rule-based routing, or electronic approvals. Those help reduce data entry, but they do not verify the truth of the invoice against the contract, tariff, or shipment specifics.

Most of these systems only check whether the overall invoice amount matches expectations, they do not validate accessorials at a line-item level, and they do not support automated disputes.

Instead, in LTL, automation must:

- Analyze each line item

- Validate accessorial charges accurately

- Compare against contract and tariff rules

- Detect nuanced reweigh, reclass, and rate mismatches

- Support efficient and automated dispute creation and workflow

That’s far more complex than simple invoice total matching, and generic AP platforms weren’t engineered with this in mind.

Introducing Lighthouz: Built for Real LTL AP Automation

Now for the real breakthrough: Lighthouz.

Lighthouz was built with LTL freight billing complexity at its core. Every part of its automation engine understands the nuances of LTL invoices and addresses the real pain points that slow down LTL brokerages: delayed customer invoicing, backlogs, wrong or duplicate payments, and missed invoices.

By tackling these issues, Lighthouz helps LTL brokers maintain cash flow, reduce disputes, and operate more efficiently.

1. How Lighthouz Automates LTL Bill Audits

Lighthouz approaches LTL carrier bill audits with LTL-specific logic, handling the LTL complexities that generic AP tools cannot manage.

A. Accessorial‑Level Validation

Instead of just checking total dollar amounts, Lighthouz dives into each charge, verifying if each charge is valid:

- Residential pickup / delivery

- Liftgate

- Limited access pickup / delivery

These accessorials are automatically validated against shipment details, location intelligence, and carrier rules to ensure accuracy before invoices move forward.

B. Validating reweighs, re-dimensions, and reclass charges

When carriers apply reweigh, redimension, or reclass charges, Lighthouz will automatically check if the supporting documents (such as inspection certificates or weight certificates) are present or not. If not, that is grounds for filing disputes to the carrier.

C. Contract and Tariff Matching

Every increase in linehaul charge is checked against the carrier tariff via the internal rating engine, so pricing errors don’t slip through. This is done for non-dynamic pricing. This ensures:

- Accurate invoicing to customers

- Preventing overpayments to carriers

- Applicable disputes with carriers

C. Automated Dispute Creation

When an incorrect overcharge or missing documents are found, Lighthouz automatically builds a complete carrier dispute packet, including all evidence, saving hours of manual work. This helps:

- Submit disputes faster

- Increase win rates in disputes

- Reduce back-and-forth with carriers

- Resolve disputes faster

- Prevent backlogs

D. Dispute Filing

Once a dispute packet is prepared, Lighthouz doesn’t stop at documentation. It automatically files disputes with carriers through the appropriate channels, ensuring accurate submission without manual intervention.

This eliminates time spent logging into portals, formatting submissions, or managing email threads, allowing AP teams to stay focused on exceptions that truly require attention.

E. Dispute Lifecycle Management

Dispute handling is fully tracked within the platform, so nothing gets lost in email threads or spreadsheets. This reduces operational risk and ensures all disputes are fully resolved. Human AP team has full visibility into all disputes.

This combination transforms LTL audit from a manual, repetitive chore into a scalable, automated process.

2. How Lighthouz Stands Out for LTL Brokers

LTL brokerages and small-to-mid size 3PLs often struggle to find a platform that automates their AP process from freight bill audit to dispute resolution. Many other platforms target large truckload brokerages and in LTL, they only handle total invoice amount discrepancy, not line item-level validations.

Lighthouz solves these gaps.

Key Differentiators in LTL

| Feature | Lighthouz | Generic Large-Broker Platform | Business Impact |

| Market Focus | Small to mid-size LTL brokers and 3PLs | Large truckload brokers and 3PLs | Supports smaller brokers without large AP teams |

| Audit Depth | Accessorial line-item level | Invoice total $ amount only | Reduces disputes, wrong payments, and skipped invoices |

| Platform Scope | LTL audits, variance management, dispute management | Partial manual audit | Handles the full AP/AR cycle with minimal human intervention |

| Automation | End-to-end: TMS entry, dispute filing, reminders, internal communication | Mostly manual audits | Eliminates backlogs, accelerates cash flow, saves labor |

| Variance Management Automation | Automated variance detection with precise, explainable exception reasons | Limited or manual variance checks | Faster exception handling, stronger margin protection |

| Dispute Automation | Automated dispute packet creation + automated carrier filing + lifecycle tracking | Manual dispute creation and submission | Faster resolutions, fewer backlogs, higher dispute win rates |

| AP Headcount Required | Low | High | Scales efficiently with fewer staff |

| Cost | Lower | Higher | More cost-effective for small-to-mid size brokers |

This clearly demonstrates why Lighthouz is the missing tool LTL brokers have been waiting for.

3. 91% No‑Touch AP & 5 days earlier customer invoicing: A New Benchmark for LTL Brokerages

Achieving 91% no-touch AP means that the majority of invoices move through audit, validation, and approval automatically, significantly reducing manual workload and processing delays.

At the same time, by eliminating backlogs and accelerating dispute resolution, brokers are able to invoice customers up to 5 days earlier, improving cash flow, strengthening financial predictability, and supporting healthier operational cycles.

A. What “No‑Touch” Really Means

The most powerful outcome of true automation is this:

Most freight bills are processed automatically with little or no manual intervention.

Lighthouz achieves this by embedding LTL logic into its audit engine. That’s why many LTL brokerages see freight bill audit processing rates reach around 91% no‑touch automation, meaning most bills don’t require human review. That kind of reliability changes team dynamics and operational scalability.

B. Industry Insight on Automation Efficiency

According to automation data from APQC, organizations that implement high levels of electronic invoicing and automated processing report significantly better efficiency metrics, including faster cycles, fewer errors, and lower cost per invoice.

In contrast, manual processes or semi‑automated systems leave teams bogged down in exception handling and costly disputes.

The Business Value Behind True LTL Invoice Automation

Day‑to‑Day Finance and Operations Impact

Here’s how brokers benefit from LTL automation when it’s truly designed for the freight world:

- Faster processing cycles — Invoices move through AP quickly, freeing capital and reducing DPO pressure.

- Lower operational cost — Automation reduces manual labor and enables leaner finance teams.

- Higher billing accuracy — Less overpayment and better customer invoicing consistency.

- Dispute cost reduction — Disputes resolve faster with complete documentation.

- Scalable workflows — Automation reinforces growth without linear staffing increases.

Industry research on AP and invoicing automation shows that reducing manual steps and increasing electronic invoice handling correlates with cost and efficiency gains — the kind of improvements that drive profitability in freight operations.

The Future of LTL Brokerage Operations

Why This Matters Now

LTL brokering is more competitive than ever. Brokers who rely on manual auditing and legacy AP systems face:

- Slower cash collection cycles

- Higher operational costs

- Inconsistent margin protection

- Greater risk of overpayments and disputes

Automation designed for freight changes the landscape. It gives brokerages a strategic advantage by eliminating needless manual work and ensuring every invoice is verified, corrected, and reconciled with speed and precision.

The Bottom Line

Brokers aren’t seeking LTL automation anymore — they’re demanding it. And not just any automation, but tools that were built for the complexity of their world.

With Lighthouz, that tool finally exists.

Ready to Transform Your LTL AP Process?

If you’re ready to automate LTL carrier bill audits, reduce manual dispute handling, and achieve high no‑touch processing rates, it’s time to see Lighthouz in action.

Take full control of your LTL finance ops by automating complex invoice audits, safeguard your margins by preventing costly errors, and scale your brokerage efficiently without the need to increase headcount or overload your team.

Book a demo with Lighthouz today and experience the automation solution your brokerage has been waiting for, finally tailored for LTL realities.